Islamabad – Register Online for FBR Tajir Dost Scheme 2024 from April 1. The government has announced the Trader Friendly Scheme 2024 to bring small traders and shopkeepers into the tax net, aimed at increasing revenue and improving business documentation in the country.

The Federal Board of Revenue (FBR) has also issued an SRO on this regard declaring that all investors and shopkeepers engaging in commercial enterprise through everlasting premises (called industrial premises hereafter), along with shops, stores, warehouses, offices, or comparable everlasting places, within the barriers of city areas, cities, and local municipal limits, may be enlisted underneath this scheme.

Registration for shops will begin from April 1, 2024. There are three ways to register under the Trader Friendly Scheme:

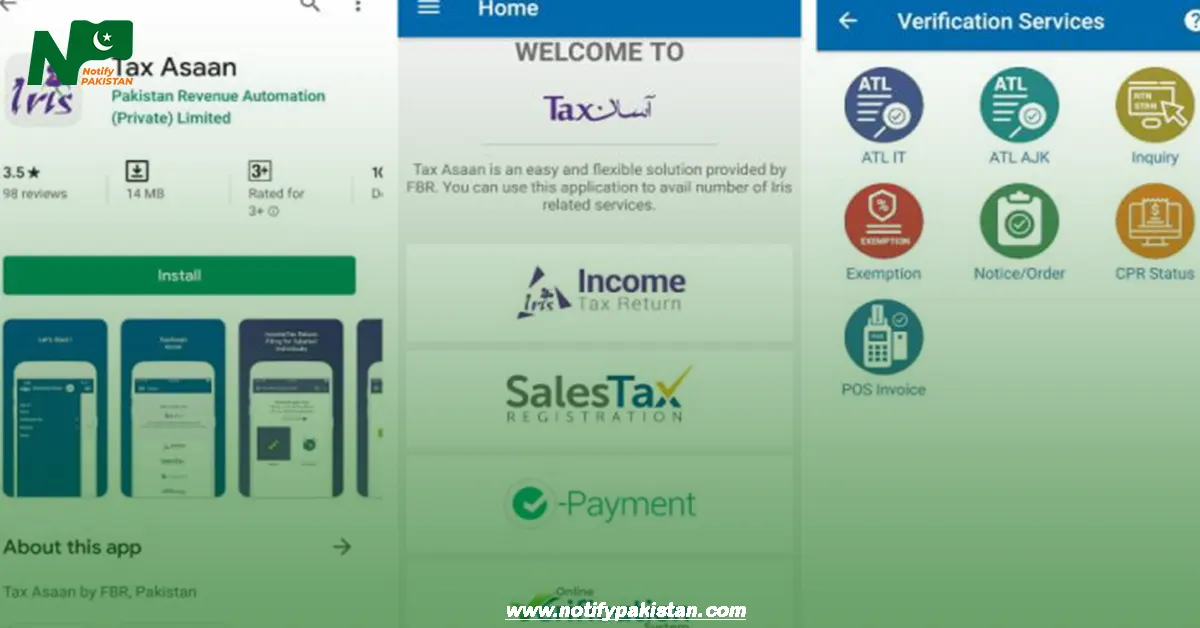

Trader Friend App FBR (Tax Asan App):

Every trader and shopkeeper can apply for registration through the Tax Asan App for National Business Registration, available for both Android and iOS systems.

Read Also: Pakistan Announced Zakat, Sadaqah-e-Fitr, and Fidya Rates

FBR Portal:

They can also apply for registration through the Federal Board of Revenue’s online portal.

FBR Tax Facilitation Centers:

Traders and shopkeepers can also visit FBR Tax Facilitation Centers for registration. They must be registered under this scheme by April 30.

It is stated in the notification that if any person, who is required to register, does not apply for registration, the Commissioner of Inland Revenue will register the trader or shopkeeper.

Follow NotifyPakistan Google News

The second part of the SRO, which relates to the payment of minimum advance tax, will be effective from July 1, 2024. Every person shall be required to pay monthly advance tax according to this paragraph.

- Shall be the least tax payable on income accruing from businesses falling under this scheme.

- The minimum tax paid under sub-paragraph

- The willpower of the amount of month-to-month enhance tax for the tax year shall be made in such way as may be prescribed.

- Where the development tax calculated under sub-paragraph (3) is zero, the minimal increase tax payable under sub-paragraph (1) shall be 1, Rs. 1200 yearly. Provided that where any individual is exempt from earnings tax underneath any provision of the Income Tax Ordinance, sub-paragraph (1) shall no longer follow.

Furthermore, it’s miles stated that the minimal develop tax can be decreased by way of twenty percent, on the full quantity or final amount: -(a) if the person can pay the total or final quantity, whichever is applicable, of the advance tax for the relevant tax yr in one installment, as read in the SRO.